We took a giant leap in 2024, redefining claims management through cutting-edge AI technology, securing strategic partnerships, and continually evolving to meet the complex needs of the insurance industry.

Arnab Dey

Co-founder and CEO, DocLens.ai

It’s 9 a.m. on a Monday morning, and Alex, a claims adjuster at a leading insurance company, settles into their desk. Their inbox is overflowing with new cases, each accompanied by hundreds of pages of reports, medical records, and incident details.

One particular case catches their eye — a multi-vehicle accident involving several claimants. Alex braces for the hours ahead, knowing the sheer complexity of piecing together timelines, injuries, and liability. They let out a sigh, wishing for a solution that could simplify the chaos and give them time to focus on what really matters: ensuring fairness and accuracy for the claimants.

At DocLens.ai, we imagined Alex’s challenge — and built a solution (trust us, we’re just getting started with making it even better).

Our mission is simple: to give risk professionals the Gift of Time.

And in 2024, we did just that!

With our advanced AI engine, claims adjusters no longer have to spend endless hours sifting through dense reports. Instead, they can create comprehensive, actionable summaries in a fraction of the time — bringing order to complexity and clarity to decision-making.

So, what made 2024 a game-changing year for DocLens.ai? Let’s take a closer look.

Tech Milestones

AI Infrastructure

2024 was a landmark year for our AI infrastructure and platform development. We built a secure, SOC 2-compliant, and continuously monitored multi-account serverless infrastructure powered by AWS Bedrock. By integrating cutting-edge models such as Anthropic, Mistral, Llama, Titan, and the upcoming Nova, we created a robust, scalable environment that empowers our clients with unparalleled AI capabilities.

Security and compliance were at the heart of our efforts, with guardrail-driven measures ensuring data integrity and trust at every step. This blend of advanced technology and rigorous safeguards underscored our commitment to providing best-in-class solutions for the insurance industry.

Advancing AI Algorithms

In 2024, we achieved significant breakthroughs in our AI algorithms, revolutionizing how risk signals and ICD-10 medical codes are extracted from insurance claims documents. By embedding transparency and traceability through source citations, we tackled the challenge of mitigating hallucinations effectively.

Our collaboration with industry experts led to the creation of templated tools designed for concise and accurate summary generation, covering use cases like insurance cases, demand packets, and chronological medical records. To uphold exceptional quality, our summaries were equipped with built-in evaluation metrics that set a new standard for precision.

At the core of these advancements is our proprietary, patent-protected method that integrates Retrieval-Augmented Generation (RAG), prompt engineering, and agentic search. This innovative approach empowers decision-making processes across diverse insurance applications, enhancing outcomes with smarter, faster insights.

Curated Data

Building on our advancements, we enhanced our platform’s ability to analyze third-party data, focusing on identifying key risk signals through sentiment analysis and assessments of severity and impact. These insights provided actionable intelligence from diverse datasets, seamlessly integrating with our robust risk extraction and evaluation tools. Additionally, we began developing a next-best action recommendation tool, drawing from our deep industry experience and the extracted risk signals, empowering professionals to make faster, more informed decisions.

Agentic AI

2024 was the dawn of the Agentic era. We introduced an innovative agentic conversational chatbot interface, designed specifically to transform the claims document processing experience. This feature highlights our commitment to enhancing user engagement through AI-driven solutions. It enables seamless navigation and extraction of critical information from complex claims documents, making the process faster, more intuitive, and highly efficient for claims professionals.

User-friendly Design

To complement our AI advancements, we launched a streamlined, interactive user interface focused on enhancing the claims professional experience. Designed with usability and accessibility in mind, this updated UI integrates seamlessly with our robust API, email, and FTP-based solutions. It supports scalable, asynchronous, and event-driven document ingestion and analysis, ensuring efficient navigation, smooth interaction with claims documents, and seamless processing of large data volumes with minimal latency. The result is a powerful yet intuitive tool that makes handling complex claims data faster and more efficient.

The strides we’ve made in AI infrastructure, model integration, data analysis, and user experience have set the stage for the next chapter of growth at DocLens. With these innovations, we’re primed to scale our platform to meet the needs of hundreds of enterprise customers, handling millions of documents with ease. Our enhanced capabilities will empower clients to achieve faster, more accurate decision-making, delivering impactful solutions that drive meaningful outcomes across the insurance industry.

What 2024 Taught Us About Product-market Fit

Our journey at DocLens.ai has been shaped by a powerful insight — Complex Claims Risk Management is a massive problem in an industry traditionally underserved by advanced technology. It requires not just high-end AI expertise, but deep, specialized business knowledge to truly make a difference.

We’ve discovered that while existing tools primarily focus on basic document ingestion and classification, DocLens goes a step further by introducing a critical decision-making layer. By building on top of powerful Foundation Models (LLMs), we’ve created a system capable of delivering meaningful, actionable insights for complex claims.

Our proprietary models don’t work in isolation. They harness the power of third-party data, extracting valuable insights from unstructured documents that were previously too cumbersome to process. To convert those insights into real actions, we’ve built a recommender engine that generates intuitive, user-friendly reports, ensuring our clients get the information they need at the right time.

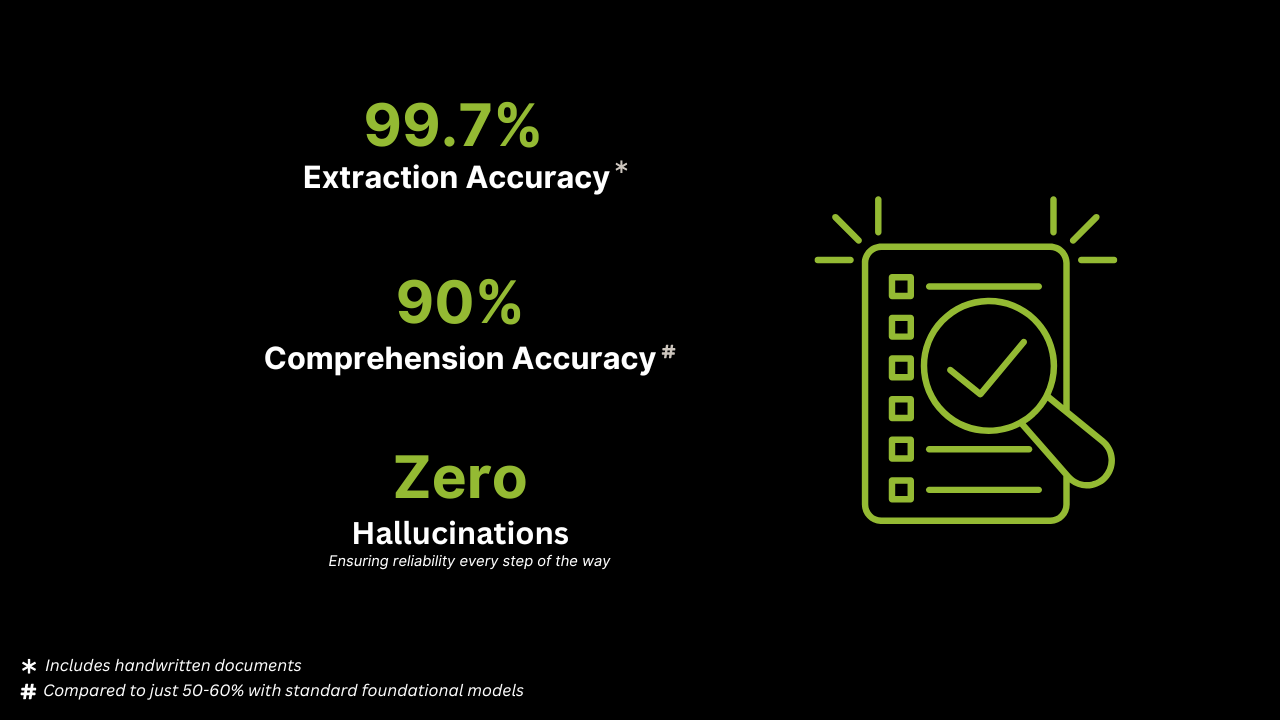

What sets us apart? Accuracy. While off-the-shelf products may struggle to provide the level of precision our clients demand, we deliver:

Our customers can clearly see the path to value realization — with results like 2-4% loss avoided, 10-20% time saved, and significant accuracy improvements. These numbers are already compelling, and as we continue to enhance our platform, we’re excited to see even greater results in the future.

But we didn’t stop there.

We’ve listened closely to what our customers want:

- A modular approach to meet diverse needs

- Flexible integration methods to adapt to various customer environments

- Pay-per-use models that align with their evolving requirements

In 2024, we secured strategic partnerships that underscore the need for DocLens.ai’s solutions. We proudly partnered with a top-three global insurer on a two-year contract, demonstrating strong market confidence. Additionally, we welcomed a top-20 insurer as an investor, reinforcing our industry impact. Our pilot programs with other customers are already showing promise, and early feedback reveals high customer satisfaction, further validating our product-market fit and the value we bring to the insurance sector.

As AI adoption continues to rise, we’re also fully committed to building responsible and ethical AI solutions. That’s why DocLens.ai is SOC-2 Type II certified, ensuring trust and transparency every step of the way.

Recognized for Excellence

At DocLens.ai, we’re redefining the future of claims management. In 2024, our commitment to innovation was recognized on multiple fronts.

We filed a patent for one of our groundbreaking technologies, with another one already in the works, demonstrating our dedication to pushing the boundaries of what’s possible in AI-driven claims management. But our innovative spirit didn’t stop there. We were also recognized as one of the top players in the Insurtech space by some of the most prestigious industry platforms, including Insurtech NY, Plug & Play, and the Erie Chamber of Commerce Accelerator.

Additionally, we earned a place among the Top 10 startups at the TiE Global Summit, competing against over 1,300 startups from around the world. These recognitions are a testament to the transformative potential of DocLens.ai — and they inspire us to continue driving innovation as we embark on the next phase of our journey.

Growing with Outstanding Talent at Our Side

Last year, we laid the foundation for our India team in Bengaluru, bringing together brilliant software engineers and data scientists. Each of them has been instrumental in driving our progress, using their expertise to turn ambitious ideas into groundbreaking solutions.

With this strong team in place, we’re excited to build on our success and continue welcoming more exceptional individuals to propel DocLens.ai to even greater heights.

Onward to 2025

As we begin 2025, I feel a sense of gratitude for how far we’ve come, and excitement for what’s ahead. The momentum we’ve built in 2024 sets a solid foundation for us to push the boundaries even further. With our advancements in AI, the expansion of our team, the strength of our partnerships, and the confidence of our investors, the future is brimming with possibilities. We’ve only scratched the surface of what we can achieve, and I’m looking forward to working alongside our talented team and valued customers to shape the next chapter.

Comments

Sorry, Comments are closed!