By DocLens AI

Why agentic AI matters to insurance claims

Agentic AI, an autonomous artificial intelligence that can plan, decide and act, is transforming insurance claims processing. Unlike traditional automation, agentic AI uses software agents to handle complex workflows from first notice of loss (FNOL) to settlement, reducing cycle times and operational costs. For insurers and law firms managing claims litigation, this technology accelerates document review, evidence assembly, and compliance tracking while maintaining human oversight.

Definition: What is agentic AI?

Agentic AI refers to autonomous software agents that perceive, plan, execute, and learn from feedback. Key characteristics include autonomy (acting without step-by-step instructions), goal-orientation, planning capability, and adaptivity. These agents leverage large language models (LLMs) for natural language understanding while using additional modules for data extraction, system integration, and decision-making.

How multi-agent systems work

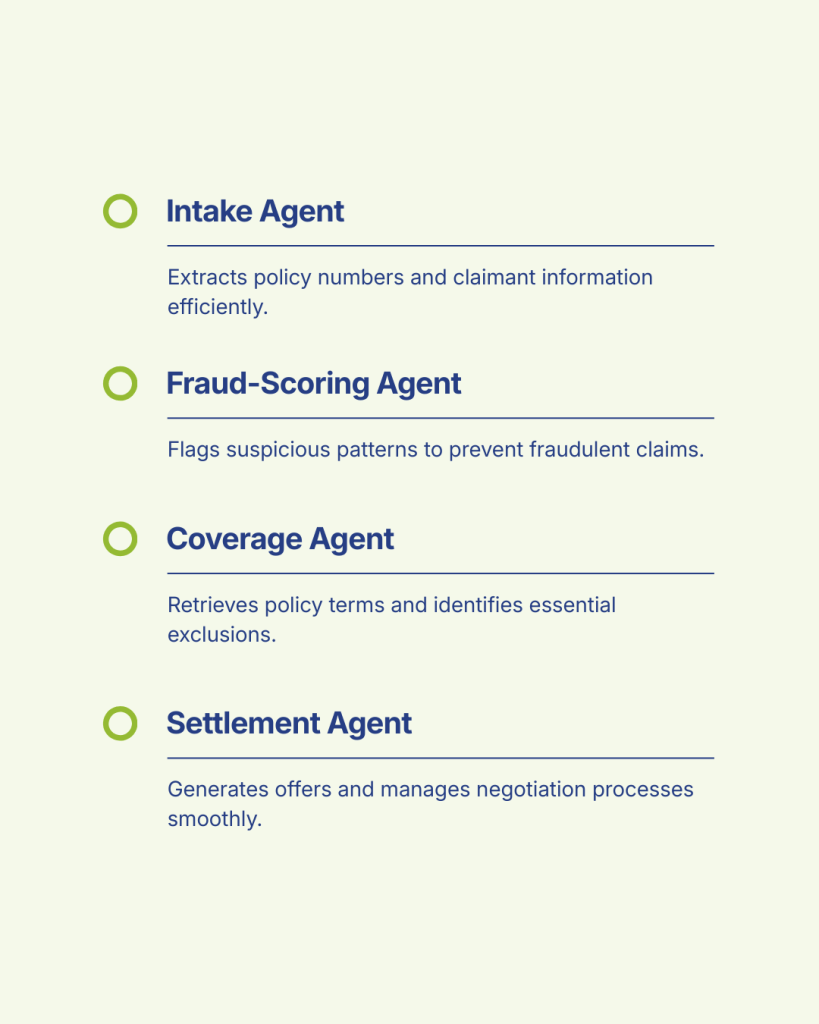

Multi-agent systems coordinate specialized agents to handle complex tasks. In insurance claims, different agents manage specific functions:

These agents share data through a central claim file and communicate via an orchestrator that assigns tasks and resolves conflicts. This parallel processing reduces cycle times while maintaining audit trails and escalation paths for human oversight.

Technically, core MAS behaviors include the following:

MAS combines planning algorithms, RL/heuristics, and LLMs for language tasks; engineering focuses on safe execution, explainability, state management, and human-in-the-loop controls.

Claims-specific benefits of agentic AI

Agentic AI delivers benefits across the claims lifecycle. Here are the core advantages with insurance claims in mind:

Faster cycle times and straight-through processing (STP)

By autonomously handling routine tasks (intake, document extraction, simple repair approvals), agents increase the percentage of claims that can be closed without human intervention. Time-to-payment shrinks and customer satisfaction rises.

Better triage and severity estimation

Multi-agent systems combine natural language understanding, image analysis (photos of damage), and structured signals to classify claims more accurately. That means higher accuracy in routing to FNOL handlers, health providers, or SIU (special investigations unit).

Cost reduction

Automating repetitive work-data entry, first-pass document review, and standard correspondence – reduces costs and frees skilled adjusters for complex work.

Improved consistency and compliance

Agentic systems can standardize decisions and execution process and improve adherence to standard operating procedures and best practices.

Enhanced fraud waste and abuse detection

Specialist agents can run cross-data checks, correlate social data, detect anomaly patterns across claim portfolios, and trigger focused investigations earlier in the process.

Smarter settlements and negotiation

Settlement agents can generate evidence-based offers, reference precedent, and perform scenario simulations. Combined with human oversight, these agents help optimize settlement outcomes and speed resolution.

Better collaboration with law firms

For claims involving litigation, agentic AI can prepare litigation bundles, summarize documents for counsel, extract key facts, and monitor issue deadlines. Law firms benefit from cleaner, indexed, and prioritized data, enabling lower review costs and faster legal responses.

Document processing at scale

Agentic systems make large document sets searchable, classify items (medical records, police reports, policy endorsements), and extract obligations, coverage language, and key dates – all in a format that downstream agents and humans can act on.

Real-world workflows automated (examples and end-to-end scenarios)

Below are concrete workflows that insurers and law firms can start automating with agentic AI today. Each workflow includes the agentic components involved and the value drivers.

Workflow A: Automated FNOL to Payment for Low-Complexity Property Claims

Scenario: A homeowner reports a minor water leak.

Agents involved: Intake agent, Coverage agent, Photo-analysis agent, Estimate generation agent, Payout agent, Compliance agent.

Steps automated:

- Intake agent ingests a photo and voice/text description, extracts policy number, incident date, and contact info.

- Coverage agent retrieves the policy and identifies relevant dwelling coverage and deductibles.

- Photo-analysis agents assess damage severity using image models.

- The estimator generates a repair estimate (or integrates with preferred vendors) and recommends an offer.

- Payout agent issues electronic payment and closes the claim after the compliance agent records the audit trail.

Value: Reduced cycle time (hours vs. days), lower adjuster workload, improved customer NPS.

Workflow B: Complex Liability Claim (Evidence Assembly & Litigation Prep)

Scenario: Auto collision with contested liability and bodily injury claims.

Agents involved: Extract agent, Evidence collection agent, Timeline agent, Liability analysis agent, Document-prep agent, Liaison agent.

Steps automated:

- Extract agent extracts and centralizes all incoming documents (police report, photos, medical records).

- Evidence collection agents request missing records (e.g., hospital records) via EDI or letter generation and track responses.

- Timeline agent constructs a fact chronology from documents and witness statements.

- Liability analysis agent applies precedent and policy language to generate a risk profile and litigation recommendation.

- Document-prep agent prepares a litigation bundle for outside counsel, annotated with redlines and key citations.

- Liaison agent coordinates scheduling and sends status updates to claimant counsel.

Value: Faster prep for counsel, reduced document review costs, improved defense strategy through structured timelines.

Law firms and document processing: How agentic AI helps legal workflows

Law firms handling insurance litigation benefit from agentic AI through automated document review, screening of key claim matters, and evidence assembly. Key applications include faster intake and matter creation, AI-powered document classification for discovery, automated legal research with precedent extraction, and negotiation support using settlement data analysis. These tools reduce review costs, accelerate case preparation, and improve billing accuracy.

For law firms, the combination of document processing and agentic workflows means lower cost per matter, better defensibility (through consistent audit trails), and faster determination of legal strategy.

Risks, controls, and governance considerations

Agentic AI introduces new operational risks that must be managed carefully:

1. Decision transparency and explainability

Agents make recommendations that impact payments and legal positions. Systems must generate human-readable rationales and preserve provenance (which data and rule produced an outcome).

2. Human-in-the-loop (HITL) design

Not every action should be fully autonomous. Establish clear thresholds: when does an agent act autonomously (e.g., payouts under $X) vs. when does it require human sign-off?

3. Regulatory compliance and audit trails

Regulators in insurance and legal practice expect record retention, explainability, and adherence to consumer protections. Agents must log actions, communications, and decision rationales.

4. Bias and fairness

Claims decisions can disproportionately affect vulnerable groups. Validate models for disparate impacts and introduce fairness constraints.

5. Security and data privacy

Claims and legal files contain sensitive Personally Identifiable Information (PII) and health data. Strict data governance, encryption, and access rules are mandatory.

6. Model drift and validation

Agents’ models must be continuously validated against performance metrics and retrained when data distributions change.

7. Vendor and third-party risk

If using external LLM APIs or AI platforms, control data flow (what’s shared with vendors) and ensure SLAs, compliance, and exit strategy.

A governance framework should include an executive sponsor, cross-functional risk committee, model-risk management processes, and periodic external audits.

Implementation checklist (practical steps for insurers & law firms)

- Identify high-value pilot use cases: For example, low-complexity property claims, subrogation triage, first-pass document review.

- Map data flows and integrate systems: Claims systems, policy admin, vendor portals, e-discovery tools.

- Design governance and HITL thresholds: Specify autonomy levels and escalation paths.

- Build modular agent architecture: Separate perception (extraction), reasoning (planning), and action (execution) layers.

- Secure data & vendor contracts: Encryption, access controls, and vendor data policies.

- Measure and iterate: KPI examples – cycle time, % STP, dispute rate, legal review hours saved, recovery rate.

- Train staff: Claims adjusters, SIU, and counsel need training to work with and review agent outputs.

- Scale thoughtfully: Expand automation once reliability and compliance are proven.

FAQs

Q: Is agentic AI the same as an LLM?

A: No. Agentic AI uses LLMs for language tasks, but it also includes planning, state management, and action execution components. An LLM is often a part of an agent, not the whole.

Q: Can agentic AI decide to pay a claim without human approval?

A: Yes – but only within predefined thresholds and governance controls. Most insurers prefer an HITL model where human sign-off is required above certain limits or for flagged cases.

Q: How does agentic AI affect law firms working with insurers?

A: It reduces document review time, automates evidence assembly, speeds litigation prep, and improves accuracy of legal discovery. Firms can focus on strategy and complex advocacy.

Comments